Why Homeownership Is the Smartest Way to Build Wealth: A Realtor’s Perspective

If you’re debating whether to keep renting or to start the journey toward owning a home—this article is for you.

As a real estate professional, I see both sides every day. I work closely with renters and first-time buyers alike, and I can tell you with certainty: the wealth gap between homeowners and renters is growing fast—and it’s no coincidence.

Let’s take a closer look at what the numbers say, and more importantly, what it means for your financial future.

📊 The Wealth Gap Between Homeowners and Renters Is Real—and Growing

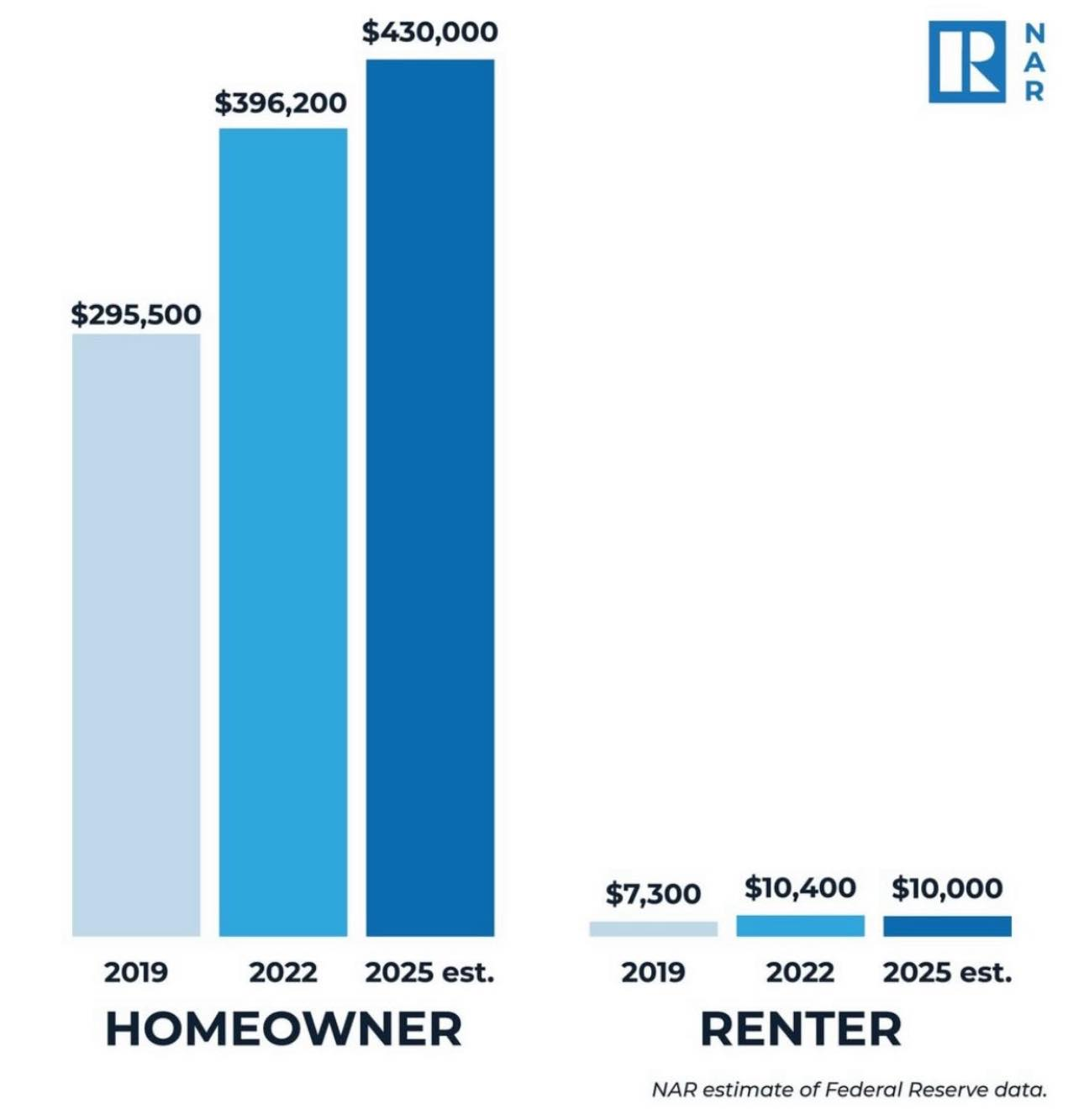

According to the National Association of Realtors (NAR), using data from the Federal Reserve, the difference in median net worth is staggering:

🏡 Homeowners:

2019: $295,500

2022: $396,200

2025 (estimated): $430,000

➡️ Increase of $134,500 in just six years — nearly 45% growth in net worth.

🏠 Renters:

2019: $7,300

2022: $10,400

2025 (estimated): $10,000

➡️ Virtually no net worth growth from 2022 to 2025.

By 2025, the projected difference in net worth between homeowners and renters will hit $420,000 — a life-changing figure that reflects more than just money.

💡 Why Do Homeowners Build Wealth So Much Faster?

From both data and real-life experience, I can point to three key reasons:

✅ Real estate appreciates over time

Home values generally rise year after year, especially in growing markets.✅ Equity builds with every mortgage payment

Unlike rent, mortgage payments go toward your ownership stake in the home.✅ Tax benefits and compound growth

Homeowners often receive tax deductions and benefit from long-term value appreciation—this is the power of compounding.

In contrast, rent is a consumption expense. It provides shelter, yes—but it doesn’t build equity, ownership, or wealth.

⚠️ $420,000: The Wealth Gap You Can’t Ignore

That’s the projected difference in median net worth by 2025 between the average homeowner and renter.

But it’s not just about the number. That gap represents real differences in:

Retirement readiness

Financial freedom

The ability to invest in children’s education

Long-term security and lifestyle choices

🧭 What If I’m Not Ready to Buy a Home Right Now?

Not everyone can (or should) buy immediately—and that’s okay.

What matters most is having a plan to build wealth, even if it doesn’t start with a house right away. Here are some options:

🏢 Invest in REITs (Real Estate Investment Trusts)

These let you participate in real estate growth without owning property.📈 Start with index funds or long-term stocks

Building any kind of investment portfolio early pays off down the road.💳 Build savings and strengthen your credit profile

Prepare now so that you’re ready when the right opportunity comes along.

⏳ The sooner you start, the more powerful your compounding will be.

📩 Final Thoughts: The Best Time to Start Is Now

Homeownership is not just the “American Dream.” It’s a long-term strategy for financial stability and generational wealth.

And if you’re feeling uncertain about whether it’s time to buy or continue renting, I’m here to help guide you through the decision-making process—with no pressure, just real answers.

📣 Ready to Talk or Take a Tour?

💬 If you're curious to learn more or would like to tour homes in your area, feel free to reach out directly:

📲 CONTACT ME

Phat Phan (Paul Phan)

Maison by Phan | Frontier Realty | DRE#: 02226917

📧 Paul@maisonbyphan.com

☎️ Call/Text: 714-717-8088